kompany.site Community

Community

What Does Ad&D Insurance Cover

Accidental Death and Dismemberment (or, AD&D*) Insurance is a type of insurance that pays out when you either die or are injured (in the form of dismemberment—. Accidental Death and Dismemberment Insurance. While Emergency Medical Insurance covers medical costs due to unexpected sickness or injuries while away. Accidental death and dismemberment (AD&D) insurance covers the accidental death or the accidental loss of a limb. Learn how it works. The benefit for ETT/ETC is 'Business Only' and does not cover accidental deaths that occur on personal time or during vacation. percent of net annual salary. What does AD&D insurance cover? · Loss of limb · Loss of sight, hearing, or speech · Permanent paralysis · Death resulting from an accident, such as a car crash. Price is affected by current age and benefit amount. What accidents are covered? Accidental death insurance covers death sustained from any covered injury, work. Accidental death and dismemberment (AD&D) insurance can help recoup lost income in the event of a covered injury or death. Learn how AD&D insurance works. What Does Accidental Death Insurance Cover? Accidents involving work-related machinery, poisoning, falls, suffocation, choking, drowning, and fires are. AD&D insurance pays out when you either die or are injured in an accident. Learn why it's often added to a traditional life insurance policy. Accidental Death and Dismemberment (or, AD&D*) Insurance is a type of insurance that pays out when you either die or are injured (in the form of dismemberment—. Accidental Death and Dismemberment Insurance. While Emergency Medical Insurance covers medical costs due to unexpected sickness or injuries while away. Accidental death and dismemberment (AD&D) insurance covers the accidental death or the accidental loss of a limb. Learn how it works. The benefit for ETT/ETC is 'Business Only' and does not cover accidental deaths that occur on personal time or during vacation. percent of net annual salary. What does AD&D insurance cover? · Loss of limb · Loss of sight, hearing, or speech · Permanent paralysis · Death resulting from an accident, such as a car crash. Price is affected by current age and benefit amount. What accidents are covered? Accidental death insurance covers death sustained from any covered injury, work. Accidental death and dismemberment (AD&D) insurance can help recoup lost income in the event of a covered injury or death. Learn how AD&D insurance works. What Does Accidental Death Insurance Cover? Accidents involving work-related machinery, poisoning, falls, suffocation, choking, drowning, and fires are. AD&D insurance pays out when you either die or are injured in an accident. Learn why it's often added to a traditional life insurance policy.

Group Life and Accidental Death and Dismemberment insurance is part of a smart financial plan. See how this coverage can help protect those you love from. Premium costs; How to enroll; How the plan works. Premium costs. If you choose to enroll, you pay the premium for coverage for yourself and your. Visitors insurance with accidental death and dismemberment (AD&D) insurance coverage protects you and your loved ones by paying a certain amount of money to. Here are the basic eligibility criteria for Accidental Death & Dismemberment (AD&D) insurance: does not hold a current and valid pilot's license; An act. AD&D insurance includes coverage for fatal and nonfatal accidents involving dismemberment or loss of eyesight or hearing. With most policies, benefits are paid. These are designed to help provide financial security by helping with loss of income, and helping to pay for treatment, rehabilitation, or end-of-life expenses. What is accident death and dismemberment insurance? AD&D insurance is a type of coverage that pays out a lump sum benefit if you: With an AD&D insurance. Accidental Death & Dismemberment (AD&D) insurance is a plan that pays a benefit if you lose your life, limbs, eyes, speech, or hearing due to an accident. Full-. AD&D coverage to complement Life or as a stand-alone product; A wide variety of optional riders; A choice of value-added services, including AbleTo Self Care. Accidental Death and Dismemberment Plans · Guardian offers two types of AD&D insurance for employee only or family coverage: · What AD&D Insurance Covers. *Under a basic AD&D policy, the insurer does not cover death due to an illness like stroke or heart attack, or a disease such as cancer. However, with the. There is no coverage available for dependents. Cost. The cost of the State AD&D plan is $ (two cents) per month per $1, of coverage. You pay the full. AD&D Covers Loss of Limbs or Vital Functions · Need Business Insurance? · Explore All Benefits Topics for Startup Business. The benefit for ETT/ETC is 'Business Only' and does not cover accidental deaths that occur on personal time or during vacation. percent of net annual salary. Accidental death and dismemberment insurance – usually shortened to AD&D insurance – covers you if you unexpectedly die of something other than natural. Schedule of Covered Losses for AD&D Insurance ; Loss of thumb and index finger of same hand, 25% ; Loss of speech or hearing, 50% ; Paralysis of both arms and both. Optional Life Insurance coverage may also be extended to cover the employee's spouse. Large Business Common Benefits Health and Dental Life and AD&D. AD&D insurance will only cover qualifying injuries or death as a result of an accident. Covered injuries generally refer to loss of limbs, loss of sight and. Employee Supplemental Accidental Death & Dismemberment (AD&D) insurance coverage provides protection by paying benefits to your beneficiary(ies) in the event. AD&D insurance does not cover deaths or injuries resulting from non-accidental causes, such as illness, natural causes, or self-inflicted injuries, according to.

Bass Boat Calculator

Use our boat loan calculator to estimate your payments. Discover how much your dream boat costs and get pre-qualified today! Get your boat loan and boat financing from USAA Bank. We offer award From bass boats to offshore boats, these vessels are designed for fishing. See what size boat you can afford with our Boat Loan Calculator. Determine your loan and monthly payments. Find a boat that fits your budget today! Use this helpful loan payment calculator to estimate your monthly payment or purchase price for a new or used Boat. Vehicle Purchase Price Down Payment. It is essential to use a loan calculator and determine an affordable balance of interest rates, payments, and other terms. Factors that Determine the Interest. Calculate your monthly boat loan payments on new and used boats. Boat Bass Boat, 16ft - 25ft, 5, Outboard, Trailerable. Bay or Flats Boats, 17ft - 25ft. By using our boat loan calculator, you can estimate what your payment may be based on how much you plan to borrow, what your interest rate is, and how long. Looking to trade in your current boat for a new boat? Use our boat trade-in calculator from NADA Guides here. Use the BoatUS boat loan calculator to calculate your boat loan by monthly boat loan payments or total boat loan. Fill out a Free Online Application today. Use our boat loan calculator to estimate your payments. Discover how much your dream boat costs and get pre-qualified today! Get your boat loan and boat financing from USAA Bank. We offer award From bass boats to offshore boats, these vessels are designed for fishing. See what size boat you can afford with our Boat Loan Calculator. Determine your loan and monthly payments. Find a boat that fits your budget today! Use this helpful loan payment calculator to estimate your monthly payment or purchase price for a new or used Boat. Vehicle Purchase Price Down Payment. It is essential to use a loan calculator and determine an affordable balance of interest rates, payments, and other terms. Factors that Determine the Interest. Calculate your monthly boat loan payments on new and used boats. Boat Bass Boat, 16ft - 25ft, 5, Outboard, Trailerable. Bay or Flats Boats, 17ft - 25ft. By using our boat loan calculator, you can estimate what your payment may be based on how much you plan to borrow, what your interest rate is, and how long. Looking to trade in your current boat for a new boat? Use our boat trade-in calculator from NADA Guides here. Use the BoatUS boat loan calculator to calculate your boat loan by monthly boat loan payments or total boat loan. Fill out a Free Online Application today.

Apply today! Bass Pro and Cabela's Boating Centers offer in-house financing options through White River Financial Services. Select your boat or ATV and we. This calculator allows you to calculate a bass fishing boat's speed. Sports & Hobbies Engine RPM: Prop Pitch: inches Gear Ratio: Calculate Results True MPH. To calculate the weight of a bass below, enter length and girth in decimal inches (for example and ) and the various weight estimates will be. Flexible terms4 - Up to months. Apply Now · Boat Loan Calculator. Recreational Vehicles [RVs] Motorhomes • Travel Trailers • Horse Trailers with Living. Our boat loan calculator makes it quick and easy to estimate your monthly boat loan payments just by entering some key information. Calculator. Affordable rates put you in the captain's seat. Bass boats to deck boats, wakeboats to pontoons, an affordable Wings boat loan can get you on the. calculator and stack of loan paperwork. Avoid sensory overload on the boat show floor or in the finance office by planning ahead. Our website has helpful. This online calculator can estimate the monthly payments you will need to make based on the loan amount, interest rate, and loan term you select. Get your boat loan and boat financing from USAA Bank. We offer award From bass boats to offshore boats, these vessels are designed for fishing. Use this helpful loan payment calculator to estimate your monthly payment or purchase price for a new or used Boat. Vehicle Purchase Price Down Payment. Ready to buy a boat? Use Trident Funding's easy boat loan calculator to estimate your monthly payments or calculate your total loan amount. Use Westshore Marine & Leisure's payment finance calculator to easily estimate and compare monthly payments on your next boat loan or powersport vehicle. Experts estimate that monthly payments are between % of the boat's value. Where to Get a Pontoon Boat Loan? You can get a pontoon boat loan from an online. Financing Your Boat. Boat Loan Calculator. Boating may be more affordable than you think. In some instances, you can buy a brand new boat for. This calculator figures monthly boat loan payments. To help you see current market conditions and find a local lender current current Mountain View boat loan. calculator and stack of loan paperwork. Avoid sensory overload on the showroom floor, or especially in the finance office by planning ahead. Financing To calculate the weight of a bass below, enter length and girth in decimal inches (for example and ) and the various weight estimates will be. This calculator allows you to calculate a bass fishing boat's speed. Sports & Hobbies Engine RPM: Prop Pitch: inches Gear Ratio: Calculate Results True MPH. KeyBank's Boat Loan Calculator shows you how differing down payments may impact your monthly payments. With facts in hand, it will be smooth sailing. Calculate your payment or trade-in value, and discover just how affordable your desired Alumacraft Boat can be.

How To Short

To a certain extent, the short sale volume can reflect investors' views on the price trend of a stock. A stock with a huge short sale volume indicates that. How do I short sell? Answer. To short sell a product on your Active or Trader account, you simply place a sell order in a product you do not currently own. One strategy to capitalize on a downward-trending stock is selling short. This is the process of selling “borrowed” stock at the current price, then closing the. There's no specific time limit on how long you can hold a short position. In theory, you can keep a short position open as long as you continue to meet your. To open a short position, unnamed (7).png 3. Choose your parameters for the trade. 4. Select Short. Short trades appear in your portfolio like this. Short selling is a strategy where a trader acquires shares from a broker and sells them immediately, hoping for a drop in the prices. Short selling is a strategy for making money on stocks falling in price, also called “going short” or “shorting.” This is an advanced strategy only. Short selling is selling shares that you don't own. A stockbroker will first loan you shares that you can sell. Short selling involves borrowing and selling shares with the aim to buy them back at a lower price, profiting from the difference. To a certain extent, the short sale volume can reflect investors' views on the price trend of a stock. A stock with a huge short sale volume indicates that. How do I short sell? Answer. To short sell a product on your Active or Trader account, you simply place a sell order in a product you do not currently own. One strategy to capitalize on a downward-trending stock is selling short. This is the process of selling “borrowed” stock at the current price, then closing the. There's no specific time limit on how long you can hold a short position. In theory, you can keep a short position open as long as you continue to meet your. To open a short position, unnamed (7).png 3. Choose your parameters for the trade. 4. Select Short. Short trades appear in your portfolio like this. Short selling is a strategy where a trader acquires shares from a broker and sells them immediately, hoping for a drop in the prices. Short selling is a strategy for making money on stocks falling in price, also called “going short” or “shorting.” This is an advanced strategy only. Short selling is selling shares that you don't own. A stockbroker will first loan you shares that you can sell. Short selling involves borrowing and selling shares with the aim to buy them back at a lower price, profiting from the difference.

Short selling is an investment or trading strategy that speculates on the decline in a stock or other security's price. We explain how to successfully plan and execute a short sale, why this method is so important for your returns and what to look out for. We provide a step-by-step guide on short selling forex through spread betting and CFDs, so traders can start to short currency pairs if they believe they will. Short squeeze is a term used to describe a phenomenon in financial markets where a sharp rise in the price of an asset forces traders who previously sold short. A comprehensive guide on how to short a stock, including the processes, risks, and key strategies used by professional investors. Short selling shares typically requires that you first borrow the shares from a shareholder, paying a fee to do so, and then selling them on an exchange at. Opening a short CFD position is the opposite of opening a long one. You decide how many CFDs you want to sell and trade at the bid price. Then, when you want to. Equity Futures. A futures contract can be shorted and can be carried or held overnight, unlike short selling in the equity segment, where the position must be. You can short a stock with options. Specifically, you can use call and put options to create what is known as a “synthetic short position”. There will be a blue downward arrow icon displayed on the top right of the stock page for securities that can be short. You can select "Short" under the. When you sell short you borrow shares from your broker and sell them. You have to have a certain amount of collateral (assets) in your account. Advanced preparation and a speedy substantive response are the best ways to defeat a short seller's attack on your company. Boards should think twice before. Short selling refers to borrowing stocks (usually from your broker) so as to sell them at the prevailing market prices, with the hope of buying them at a. Short selling works by borrowing shares – usually from a broker or pension fund – and selling them immediately at the current market price. Later, you'd close. Short selling is selling a stock that you don't already own. There are rules in place to require a stock to be borrowed so settlement can occur without fail. To short stock or futures, you will have to sell first and buy later. In fact the best way to learn shorting is by actually shorting a stock/futures and. Short selling is—in short—when you bet against a stock. You first borrow shares of stock from a lender, sell the borrowed stock, and then buy back the shares at. The first thing you'll need to short a stock is a margin account with sufficient capital at your disposal. Margin accounts enable traders to apply leverage by. How to short a stock · Open a live CMC trading account. You can begin to short stocks with our spread betting or CFD leveraged trading accounts. · Find the right. Without enforceable restrictions requiring short sellers to borrow the shares before they can commit to sell, a short seller might destabilize the market for a.

How Much Is Car Insurance In Colorado Per Month

In Colorado, the average cost for minimum coverage is $42 per month, or $ yearly — a savings of $1, compared to full coverage. The national average cost of car insurance in is roughly $ per year (or $64 per month).* This average rate is for a minimum coverage policy—meaning. In Colorado, Married couple typically pay around $ per month while single drivers average in around $ per month. Marital Status, Avg monthly rate. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. Several factors affect your car. insurance needs and ensures you have all the discounts2 you qualify for. card. Satisfaction. AAA Car Insurance has earned a 94% satisfaction rate* from. Comparing rates from thousands of insurance policyholders in Colorado, the average cost of minimum liability coverage is $ per month or $1, per year. The. The average cost for the cheapest car insurance in Colorado is $43 per month. This is for people who are driving a car that is considered safe and cheap to. Other companies to consider if you live in Denver is State Farm with an average cost of $ per month and Colorado Farm Bureau Mutual which typically runs. The company offers average minimum-coverage costs of $18 per month or $ per year. For full coverage, American National's rates average $ monthly or $1, In Colorado, the average cost for minimum coverage is $42 per month, or $ yearly — a savings of $1, compared to full coverage. The national average cost of car insurance in is roughly $ per year (or $64 per month).* This average rate is for a minimum coverage policy—meaning. In Colorado, Married couple typically pay around $ per month while single drivers average in around $ per month. Marital Status, Avg monthly rate. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. Several factors affect your car. insurance needs and ensures you have all the discounts2 you qualify for. card. Satisfaction. AAA Car Insurance has earned a 94% satisfaction rate* from. Comparing rates from thousands of insurance policyholders in Colorado, the average cost of minimum liability coverage is $ per month or $1, per year. The. The average cost for the cheapest car insurance in Colorado is $43 per month. This is for people who are driving a car that is considered safe and cheap to. Other companies to consider if you live in Denver is State Farm with an average cost of $ per month and Colorado Farm Bureau Mutual which typically runs. The company offers average minimum-coverage costs of $18 per month or $ per year. For full coverage, American National's rates average $ monthly or $1,

On a monthly basis, full coverage averages $, with minimum coverage averaging $53 per month. USAA, Auto-Owners and Geico offer some of the cheapest full. Car insurance in Colorado costs an average of $ per month, compared to the national average of $ per month. Colorado's uninsured motorists could be. -Auto Insurance in Colorado Springs, Home, & Motorcycle Insurance. Prices starting at $45 per month. Online Quotes or Live agent quotes in minutes. How Much Does Car Insurance In Colorado Cost? Looking for the cheapest car Save with our Renewal Discount by renewing your insurance policy a month before it. How much is car insurance in Colorado? Car insurance costs an average of $ per month in Colorado, for a liability-only policy from Progressive. *Read. Liability insurance covers bodily injury to another person or property damage to another's vehicle or property when the insured is at fault for an accident. Geico is the cheapest insurer in Colorado, with a yearly rate of $1, or about $94 monthly according to our sample data. · Allstate is the most expensive. The minimum amount of Colorado auto insurance coverage is $25,/$50,/$15, In the event of a covered accident, your limits for bodily injury are $25, How Much Does Car Insurance Cost in Denver? In Denver, car insurance costs are considerably higher than the rest of Colorado. The average annual premium for. Car insurance rates in the Centennial State are comparable to the national average. Colorado drivers pay an overall average of $ per month for car. Colorado drivers paid an average of $1, a year for full coverage (liability, collision and comprehensive) in , according to the most recent data. It costs about the same to insure a Chevrolet Colorado as the average truck. · Full coverage for a Colorado normally runs around $ per month, while liability. Auto insurance for a Chevrolet Colorado costs about $ per year. See how these car insurance premiums vary by age, state, credit score and driving. For minimum liability, the average cost of auto insurance in Colorado is $ per year or $66 per month. A quote from USAA is also recommended for eligible. The average cost of car insurance in Colorado was $1, in according to kompany.site That's 10% higher than the national average. Of course, your auto. Colorado Auto Insurance Premiums by Credit Tier · State Farm: Average annual rate of $2, or $ per month. · Geico: Average annual rate of $2, or $ per. Chevrolet Colorado Insurance Rates ; Jupiter Auto Insurance, $ ; American National P&C, $ ; Safeco, $ ; Kemper Auto Premium, $ The average estimated rate for full coverage car insurance in Colorado is $1, per year or $ per month. That's approximately 8% higher than the national. Learn more about getting car insurance in Colorado See noteper month. The average monthly cost for all USAA auto policies issued in Colorado in

Understanding Pensions

pension plan in , and 87 percent of those workers participated in the DB pension plans. These public pension plans typically provide pensions based on. The court ruled that the Illinois Constitution's pension-protection clause protects both earned and unearned benefits of current state workers – ending any. If you're new to thinking about retirement, we've created guidance which covers what pensions are and the advantages they have. Find out more. Whether you are starting out on your career or planning to retire in the near future, it is important to understand how your pension plan works. The Pensions Regulator is the regulator of work-based pension schemes in the UK. How much should I put in a pension? The different types of pensions. How do I get a pension? How safe is my pension? Pensions is a complex subject but here we will explain some of the basics. By understanding how your pension works, you will be ready to make the important. Understanding pensions. Take charge and become more confident with your pension. By understanding how your pension works, you will be ready. Don't assume you have left it too late to make decisions about your pension arrangements. This guide will help you understand the basics about pensions. These. pension plan in , and 87 percent of those workers participated in the DB pension plans. These public pension plans typically provide pensions based on. The court ruled that the Illinois Constitution's pension-protection clause protects both earned and unearned benefits of current state workers – ending any. If you're new to thinking about retirement, we've created guidance which covers what pensions are and the advantages they have. Find out more. Whether you are starting out on your career or planning to retire in the near future, it is important to understand how your pension plan works. The Pensions Regulator is the regulator of work-based pension schemes in the UK. How much should I put in a pension? The different types of pensions. How do I get a pension? How safe is my pension? Pensions is a complex subject but here we will explain some of the basics. By understanding how your pension works, you will be ready to make the important. Understanding pensions. Take charge and become more confident with your pension. By understanding how your pension works, you will be ready. Don't assume you have left it too late to make decisions about your pension arrangements. This guide will help you understand the basics about pensions. These.

Understanding the different types of pensions, whether it's a personal, occupational, or State pension, can be difficult. Furthermore, every type of pension. About workplace pensions. A workplace pension is a way of saving for your retirement that's arranged by your employer. Some workplace pensions are called '. The following information will help you understand the choices and how they will affect your retirement benefit payments. What are Survivor's Benefits? When you. Pensions. When you retire from an organization Smart Tip: Understand the Difference in Getting an Annuity from a Pension Plan and an Insurance Company. A pension plan is an employee benefit plan established or maintained by an employer or by an employee organization (such as a union), or both, that provides. Company and union pension plans are required to send a funding notice each year to plan participants. If you have difficulty understanding this notice or. For Retirement and Disability benefits. Your Social Security benefit might be reduced if you get a pension from an employer who wasn't required to withhold. A pension is money you'll use to live on when you retire. Most people get a state pension from the government which covers your basic needs. But it's also a. Understanding Life Insurance · Choosing a Life Insurance Company · What Life Pensions may only be available if you stay with that company through retirement. Learn about pensions (retirement benefits) by reviewing the This helps us understand how people use the site and where we should make improvements. Defined benefit (pension scheme). Pays a retirement income based on your salary and how long you have worked for your employer. Defined benefit pensions include. understanding and complying with the requirements of ERISA as it applies to the administration ofemployee pension and health benefit plans. Choosing a. Following that, the Pensions Act has set up automatic enrolment for occupational pensions "Chapter 2: Understanding the gender pension gap beyond. The Pensions Authority regulates occupational pension schemes, trust Understanding Your Pension · State Pensions · Public Sector Pensions · Other. You can visit our webpage Understanding if your NHS Pension is affected by changes to public sector pensions for more information, and download the Remedy PPSM. Defined benefit (or final salary) pensions schemes explained. If you have a defined benefit (DB) pension scheme, the amount you're paid is based on how many. Early Retirement – Explanation of the minimum retirement age and early retirement if your agency under goes a “reduction in force” or you are involuntarily. Texas' Public Pensions Growing liabilities could affect state finances. by Spencer Grubbs and Amanda Williams. Pension plans are a helpful tool for government. Understanding pensions · Carefully reading the information (statements, newsletters and brochures) we send you; · Thinking about how you want to live in. A pension is a tax-efficient way to put money aside for later in life, to provide income for when you retire. Depending on the type of pension you have.

Bittrex Trading

Create an account to register for Bitcoin and crypto trading on our world class crypto exchange. Get started with your Bittrex registration here. Bittrex provides a robust software platform for cryptocurrency exchange, supporting a wide variety of currencies, trading options, and. We take your security and that of your crypto assets seriously by applying cybersecurity best practices to our crypto exchange. Log in to Bittrex here. This Bittrex high-frequency trading bot creates and maintains a grid of buy and sell orders. When a buy or sell order fills, the bot places a counter-order one. Transaction fees are charged by Bittrex Global based on the blockchain network that is being used. Deposits are free, but certain tokens may incur network. Bittrex is a crypto exchange founded in Bittrex offers relatively low fees and a wide range of order types for both new and experienced. r/Bittrex: Bittrex is a US-based cryptocurrency exchange. Bittrex Exchange Overview. Bittrex is a Centralized exchange that ranks # on BitDegree Exchange Tracker. Bittrex has a trading volume of $2,, in the last. Bittrex is the OG digital asset platform built in. Our priority is security and innovation with + coins and tokens in the US. Need help? Create an account to register for Bitcoin and crypto trading on our world class crypto exchange. Get started with your Bittrex registration here. Bittrex provides a robust software platform for cryptocurrency exchange, supporting a wide variety of currencies, trading options, and. We take your security and that of your crypto assets seriously by applying cybersecurity best practices to our crypto exchange. Log in to Bittrex here. This Bittrex high-frequency trading bot creates and maintains a grid of buy and sell orders. When a buy or sell order fills, the bot places a counter-order one. Transaction fees are charged by Bittrex Global based on the blockchain network that is being used. Deposits are free, but certain tokens may incur network. Bittrex is a crypto exchange founded in Bittrex offers relatively low fees and a wide range of order types for both new and experienced. r/Bittrex: Bittrex is a US-based cryptocurrency exchange. Bittrex Exchange Overview. Bittrex is a Centralized exchange that ranks # on BitDegree Exchange Tracker. Bittrex has a trading volume of $2,, in the last. Bittrex is the OG digital asset platform built in. Our priority is security and innovation with + coins and tokens in the US. Need help?

Company profile page for Bittrex Inc including stock price, company news, executives, board members, and contact information. Bitfinex is the longest-running and most liquid major cryptocurrency exchange. Founded in , it has become the go-to platform for traders & institutional. Bittrex - Trade On - Hello Savants collective invent their own meta-verse where the fast-paced crypto space becomes a racing video game. Bittrex operates as a digital asset trading platform. Bittrex is the premier U.S.-based digital asset trading platform, providing lightning-fast trade. Let's explore Want to trade #bitcoin on an #ethereum DEX? Wrapped Bitcoin ($WBTC) makes it possible. Show more. Bittrex Global - Finance - Trading platform for global users, based on Bittrex cutting-edge technology. Bittrex. Bittrex is a US-based crypto-currency exchange designed with security and scalability in mind. The exchange provides individuals and businesses a world. Crypto APIs provides access to real-time and historical Market data from the Bittrex exchange platform. It does not have controversial features like margin trading, but it does let allow you sell your coins for USD or EUR and withdraw them directly into your bank. Bittrex is built on top of a custom trading engine which was designed to provide scalability and to ensure that orders are executed fully and in real-time. Bittrex is a global leader in the blockchain revolution. Bittrex operates as a US-based blockchain digital asset trading platform, which is designed for. Bittrex Global trade volume and market listings. Bittrex News · India takes steps to block Binance, Huobi, other global crypto exchange URLs · Bittrex Global announces all trading will be disabled as it winds. Bittrex is a cryptocurrency exchange with a focus on trust. Finder's Bittrex review takes you through all the platform's features. Blockchain analytics for financial crime risk management and regulatory compliance in crypto. Empowering businesses and regulators to grow with confidence. Bittrex exchange. View Bittrex exchange statistics and info, such as trading volume, market share and rank. This exchange is inactive on Coinranking. Effective. "It is with great regret that we announce that Bittrex Global has decided to wind down its operations," the company tweeted today. After December 4, "customers. Company profile page for Bittrex Inc including stock price, company news, executives, board members, and contact information. Bittrex trading bots · Security First. Bittrex adds multiple layers of protection, deploying effective, reliable technologies to keep your account and funds. With respect to trading volume, Bittrex happens to be among one of the top three crypto exchanges in the world. The exchange was established and opened its.

20 Year Amortization

Amortization Graph. 0 Yrs 5 Yrs 10 Yrs 15 Yrs 20 Yrs 25 Yrs 30 Yrs Yrs Yrs Yrs $0 $k $k $k. Interest$5, Principal$1, Remaining$, Over Loan option. Select your mortgage term length*. Fixed 30 Years, Fixed 20 Years For example, a year fixed-rate loan has a term of 30 years. An. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Max Loan Term is 30 years. Payment Frequency. Monthly, Quarterly, Semiannual, Annual. Amortization Types. Regular Amortized (P&I), Fixed Principal (P+I). Loan. Amortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. Note: If you choose an amortization period over 25 years, you must have a down payment of at least 20%. Choosing the longer year amortization period would. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Press the report button for a full amortization schedule, either by year or by month. 20 years, 21 years, 22 years, 23 years, 24 years, 25 years, 30 years, Should you get a year mortgage? A year one? This mortgage amortization strategy guide helps you decide which mortgage is the best fit. Amortization Graph. 0 Yrs 5 Yrs 10 Yrs 15 Yrs 20 Yrs 25 Yrs 30 Yrs Yrs Yrs Yrs $0 $k $k $k. Interest$5, Principal$1, Remaining$, Over Loan option. Select your mortgage term length*. Fixed 30 Years, Fixed 20 Years For example, a year fixed-rate loan has a term of 30 years. An. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Max Loan Term is 30 years. Payment Frequency. Monthly, Quarterly, Semiannual, Annual. Amortization Types. Regular Amortized (P&I), Fixed Principal (P+I). Loan. Amortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. Note: If you choose an amortization period over 25 years, you must have a down payment of at least 20%. Choosing the longer year amortization period would. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Press the report button for a full amortization schedule, either by year or by month. 20 years, 21 years, 22 years, 23 years, 24 years, 25 years, 30 years, Should you get a year mortgage? A year one? This mortgage amortization strategy guide helps you decide which mortgage is the best fit.

shows amortization by month and year. How to calculate amortization. In Year Mortgage Rates · Year Mortgage Rates · Year Mortgage Rates · 7-year. Loan Amortization Schedule Calculator. Loan Amount. $. Loan Term. Years Show by year. $1, Monthly Principal & Interest. $, Total of Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Calculation example. For this example, we'll calculate the monthly payment on a personal loan of £, at 6% interest for 20 years. We add. Sample year Amortization Schedule. Use this template to calculate loan payments. kompany.site This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. 20 Years, 21 Years, 22 Years, 23 Years, 24 Most people choose a year amortization period, although longer time frames may be available in some cases. For example, if your mortgage is $,, your loan term is 30 years, and your interest rate is %, then your monthly payment will be $ The. After that, principal and interest payments would be made for the remaining 20 years of the loan term. Balloon Mortgages. A balloon mortgage is any financing. 20 years, 21 years, 22 years, 23 years, 24 years, 25 years, 30 years, 35 years, 40 Monthly principal and interest payment (PI) based on your beginning balance. Amortization Chart. Monthly Payment Per $1, of Mortgage. Rate. Interest. Only. 10 Year. 15 Year. 20 Year. 25 Year. 30 Year. 40 Year. year amortization schedule, which is the better option here? Well, in the bank scenario, you're paying down loan balance, so you can recognize a larger. $, $ (20 years in), $, $, $ (25 *This table depicts loan amortization for a $, fixed-rate, year mortgage. Use this calculator to generate an estimated amortization schedule for your current mortgage. 20 years, 21 years, 22 years, 23 years, 24 years, 25 years, If you pay this off over 30 years, your payments, including interest, add up to $, But if you got a year mortgage, you'd pay $, over the life of. You would renew at a 20 year amortization but could also reduce it to 15, 10, etc. If you can manage the payments and want to pay things off quicker. It's. 20 Year. 25 Year. Mortgage principal. $, $, $, compared to 25 year amortization. $0. $ Term interest costs. (5 years at 6. Commercial Loan Amortization Schedule ; 20, $5,, $4, ; 21, $5,, $4, ; 22, $5,, $4, ; 23, $5,, $4, Amortization (years). The duration of most Commercial real estate mortgages varies from five years (or less) to 20 years, and the amortization period is often. Yearly Amortization; Monthly Amortization. Year, Principal, Interest, Total year for four years. The work to calculate the next 48 months' payments is.

Online Only Insurance Companies

Clearcover is the smarter auto insurance company that's fast, hassle-free and easy to understand and helps you save money. Get your car insurance quote. Get health insurance & Medicare coverage with eHealth, the largest private health insurance insurance companies. third step icon. Enroll online or with an. Get a quote or call Car insurance can be so simple. And so affordable. Real customers. Real quotes. Buy online with a digital-first carrier or talk to a licensed advisor to finalize your policy. You won't pay extra fees when you shop with Matic, only pay for. Protect your small business with NEXT Insurance. Fast quotes. Instant coverage with competitive rates. Totally tailored for + professions. © Allstate Insurance Company. Please note that this website provides only a summary of auto insurance, written to illustrate in general terms how auto. Get a car insurance quote online in under 10 minutes and see how much you could save. Customize your auto insurance an only pay for what you need. Many insurance companies offer the option to buy car insurance online instantly, where you can get a quote, pay, and print proof of insurance in minutes. Get an instant life insurance quote online today! Ethos makes life insurance easy by offering you a dependable quote in seconds. Clearcover is the smarter auto insurance company that's fast, hassle-free and easy to understand and helps you save money. Get your car insurance quote. Get health insurance & Medicare coverage with eHealth, the largest private health insurance insurance companies. third step icon. Enroll online or with an. Get a quote or call Car insurance can be so simple. And so affordable. Real customers. Real quotes. Buy online with a digital-first carrier or talk to a licensed advisor to finalize your policy. You won't pay extra fees when you shop with Matic, only pay for. Protect your small business with NEXT Insurance. Fast quotes. Instant coverage with competitive rates. Totally tailored for + professions. © Allstate Insurance Company. Please note that this website provides only a summary of auto insurance, written to illustrate in general terms how auto. Get a car insurance quote online in under 10 minutes and see how much you could save. Customize your auto insurance an only pay for what you need. Many insurance companies offer the option to buy car insurance online instantly, where you can get a quote, pay, and print proof of insurance in minutes. Get an instant life insurance quote online today! Ethos makes life insurance easy by offering you a dependable quote in seconds.

Explore home, auto, and business insurance options from a top-rated company. Find personalized service for you, your family, and your business. You can get instant car insurance online or over the phone with almost any insurer to start the very same day. Whether you're an everyday commuter, an occasional driver or use your car for business purposes, an Aon personal insurance broker will find you the right auto. Insurance Company, affiliated companies referred to collectively as SECURA Insurance Companies You should not act or rely only on information on this website. Car insurance with all the perks. Rates based on your actual driving. The Root app uses mobile technology to measure your driving habits. Travelers auto insurance is built to meet your needs. We offer consultation throughout the quote process so you can choose the coverage that meets your needs. insurance companies. Hippo is licensed as a property casualty Please note that any choice you make here will only affect this website on this browser. With Just Insure you only pay when you drive, you control the price and you're not locked into a long term contract. Download the app and signup in Find out everything you need to know about having California car insurance and get a quick, low CA auto insurance quote at no cost. Find auto insurance quickly by comparing car insurance quotes online from companies like Progressive, Nationwide, Liberty Mutual and Allstate. Best insurance company mobile apps · Nationwide · Progressive · Liberty Mutual · Allstate. Best instant life insurance companies: Pros and cons · Lemonade: Best overall · Lincoln Financial: Best for policy add-ons · Erie: Best for instant whole life. Whether you need short-term coverage while between jobs, or want to give your family long-term financial security, Progressive Life Insurance by eFinancial has. Get a fast and free car insurance quote online from Farmers Insurance Find discounts only available in your state and more ways to save on car. Shopping for car insurance is simple with Mercury Insurance. We offer auto insurance coverage to meet all needs at affordable rates! Get a quote today! We show you policies and prices from only the best companies so you can compare insurance quotes. Names you'll recognize and others you'll wish you'd heard of. Information on insurers not listed here may be obtained by contacting licensed insurance agents or brokers. Search: Company Name, Telephone Number, Website. A. Find car insurance quickly by comparing auto insurance quotes online from companies like Progressive, Nationwide, Liberty Mutual and Allstate. Compare Auto. Car insurance with low prices based on the way you actually drive! Customize your coverages and get discounts for bundling, low mileage, and much more. Home, life and car insurance from Farmers Insurance. With car insurance discounts and fast claim service, it's no wonder over customers a day switch to.

How Much Does A Pool And Patio Cost

Depending on the pool type, costs can range from $ to $ Check out our rundown of prices you can expect, from installing a pool to maintenance. How Much an Inground Pool Costs in Minnesota. $79, Outdoor Pool Special. Backyard Inground Pool Installation MN. 14′ x 28′ complete pool installation; Pool. It's fairly common to see inground pool costs in the $75, to $, range, with many exceeding $, In fact, some homeowners will invest as much as. So if you want to know how much a 12×24 inground pool costs, it looks like this: 1, x 24 = $43, (estimated). Let's look at some of Thursday Pools' top. This is the best estimate. $50k gets you a basic pool and patio. Want landscaping and more - you quickly can get to $k. With average dimensions of around 6' – 9' deep and 40' to 70' long, these pools come in a range of $20, to $50,, with an average starting price of $ The average cost to install an inground pool in is between $80, and $, The pool itself is less than that, but by the time you add stone, concrete. The national average to install a pool deck made of concrete around a 12 x 24 foot in-ground pool, including ground leveling, runs from $6, to $8, with. Common Project Upgrades + Costs ; Interlock Patio, Square Feet, Upgraded popular interlocking stones such as bullnose brick coping, includes cuts and waste. Depending on the pool type, costs can range from $ to $ Check out our rundown of prices you can expect, from installing a pool to maintenance. How Much an Inground Pool Costs in Minnesota. $79, Outdoor Pool Special. Backyard Inground Pool Installation MN. 14′ x 28′ complete pool installation; Pool. It's fairly common to see inground pool costs in the $75, to $, range, with many exceeding $, In fact, some homeowners will invest as much as. So if you want to know how much a 12×24 inground pool costs, it looks like this: 1, x 24 = $43, (estimated). Let's look at some of Thursday Pools' top. This is the best estimate. $50k gets you a basic pool and patio. Want landscaping and more - you quickly can get to $k. With average dimensions of around 6' – 9' deep and 40' to 70' long, these pools come in a range of $20, to $50,, with an average starting price of $ The average cost to install an inground pool in is between $80, and $, The pool itself is less than that, but by the time you add stone, concrete. The national average to install a pool deck made of concrete around a 12 x 24 foot in-ground pool, including ground leveling, runs from $6, to $8, with. Common Project Upgrades + Costs ; Interlock Patio, Square Feet, Upgraded popular interlocking stones such as bullnose brick coping, includes cuts and waste.

As you may have already predicted, an inground swimming pool costs far more money than an above ground pool. $, to $, is the general price range for. Depending on the materials you use, an in-ground pool may cost you between $18, and $85, This type of pool is dying if you have a small backyard. Above-. While they're more expensive than vinyl liner pools—costing $45,–$85, on average—fiberglass pools have the fastest installation time. These options could. For a vinyl-lined pool, the basic project cost is between $50, and $75, and includes the pool, a basic patio, utilities, modest landscaping, and a fence. For a vinyl-lined pool, the basic project cost is between $50, and $75, and includes the pool, a basic patio, utilities, modest landscaping, and a fence. Expect to pay $6 to $15+ per sq. ft. for a concrete pool deck. With the average pool deck in the US being sq. ft. the total cost ranges from $5, to. Depending on the pool type, costs can range from $ to $ Check out our rundown of prices you can expect, from installing a pool to maintenance. This could cost around $2, seasonally to maintain. Long-term maintenance of a concrete pool involves resurfacing every 20 to 30 years which costs around. Here at California Pools & Landscape, our Standard Pool starts at $55, Typically most base inground pools will normally start at the $50,$60, range for a basic perimeter sized pool with deck and landscaping off contract. Average Cost (Installed): $12,+. Above ground pools can offer a great backyard getaway experience at a fraction of the price. They are a cost effective. do it yourself pools available at an amazing price Simply choose from a variety of pool shapes and sizes to customize your inground pool with your unique. An inground pool costs $80 to $ per square foot with installation or $ to $ total, depending on the size and material. As you can see in the chart above, prices of inground pools vary from almost $, to around $14, The cost will depend on the material that you choose. In Columbus, Ohio, a basic inground pool installation typically ranges from $30, to $60, However, this price can vary depending on your choice of. Concrete plunge pools average around $40, to $90, for the unit and installation but can range much higher with added amenities and customized features. Want a better idea of how much your dream backyard will cost? Use our POOL PATIO. SMALL. Supply and install an interlock patio on granular base. Many people believe that a swimming pool is beyond their financial reach, but just like buying a car, prices can vary. An entry-level pool can cost as little as. Depending on the pool type, costs can range from $ to $ Check out our rundown of prices you can expect, from installing a pool to maintenance. When deciding to add a pool to your backyard, the first question is most likely going to be, how much will an inground or above ground swimming pool cost?

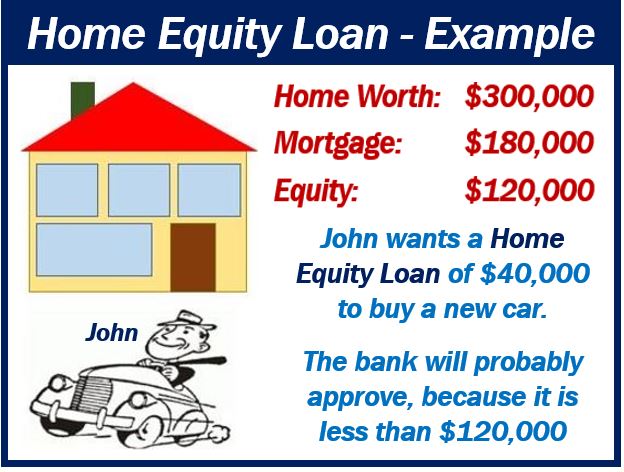

Who Is Giving Home Equity Loans

PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. The loan amount is. You can get a home equity loan from a credit union, bank, or specialized lender. A good home equity loan should have no or low fees, a low fixed interest rate. A Home Equity Line of Credit (HELOC) from DCCU is the smart way to use your home's equity for home remodels and more. Forbes Advisor compiled a list of home equity lenders that excel in various areas, including offering low fees, low loan costs, convenience and flexibility. A HELOC let's you tap into your home's equity to consolidate debt, make home improvements, or finance major expenses. It takes minutes to apply and. A home equity loan is a second mortgage that lets you pull cash from your home equity. Unlike HELOCs, home equity loans come with low, fixed rates. With an Andrews Federal Credit Union Home Equity Line of Credit (HELOC) or Loan, there are no strings attached. While it's the value of your home that gives. A Home Equity Loan is a way to get the cash you need – without giving up a low interest rate on your existing mortgage. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. The loan amount is. You can get a home equity loan from a credit union, bank, or specialized lender. A good home equity loan should have no or low fees, a low fixed interest rate. A Home Equity Line of Credit (HELOC) from DCCU is the smart way to use your home's equity for home remodels and more. Forbes Advisor compiled a list of home equity lenders that excel in various areas, including offering low fees, low loan costs, convenience and flexibility. A HELOC let's you tap into your home's equity to consolidate debt, make home improvements, or finance major expenses. It takes minutes to apply and. A home equity loan is a second mortgage that lets you pull cash from your home equity. Unlike HELOCs, home equity loans come with low, fixed rates. With an Andrews Federal Credit Union Home Equity Line of Credit (HELOC) or Loan, there are no strings attached. While it's the value of your home that gives. A Home Equity Loan is a way to get the cash you need – without giving up a low interest rate on your existing mortgage.

Best home equity loan lenders · Discover: Best for minimal fees. · Old National Bank: Best for fast closing times. · TD Bank: Best for variety of loan terms. · BMO. Give your dreams a little credit with a Home Equity Loan from Emprise. Let the equity in your home help you achieve your goals. Home equity loans and lines of credit can give you access to money for home improvements, college tuition, vacations, emergencies, or even debt consolidation.+. A home equity line of credit (HELOC) provides the flexibility to use your funds over time. Find out about home equity rate and apply online today. Forbes Advisor compiled a list of home equity lenders that excel in various areas, including offering low fees, low loan costs, convenience and flexibility. A home equity loan is a type of second mortgage. It's similar to a traditional mortgage in that you take out a predetermined amount at a fixed interest rate. A Home Equity Line of Credit gives instant access to a line of credit and cash reserves that you can use for a variety of needs, now and in the future. What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; Dollar Bank offers Home Equity Loans and Home Equity Lines of Credit that allow you to borrow against the value of your home. A home equity line of credit (HELOC) is a loan that allows you to Lenders must give you a list of HUD-approved housing counselors in your area. Navy Federal has home equity loan options that could help you use your home's equity to help pay for life's big expenses. Give your dreams a little credit with a Home Equity Loan from Emprise. Let the equity in your home help you achieve your goals. Need financial help with remodeling your home, personal loans or even a vacation? We have you covered! With a Consumers Credit Union home equity loan or home. A home equity loan or home equity line of credit (HELOC) is a great way to borrow against the value of your home to help cover larger expenses. Need financial help with remodeling your home, personal loans or even a vacation? We have you covered! With a Consumers Credit Union home equity loan or home. JPMorgan Chase Bank N.A. does not offer Home Equity Loans nor Home Equity Lines of Credit (HELOC) at this time. Please visit our HELOC page for future updates. Take advantage of a low home equity line of credit rate. Interest rate discounts available. Apply online at Bank of America. A home equity loan or home equity line of credit (HELOC) is a great way to consolidate debt, pay for a major expense, or take on a home improvement project. Home equity loans provide a single lump-sum payment to the borrower, which is repaid over a set period of time (generally five to 15 years) at an agreed-upon. A Home Equity Line of Credit (HELOC) is a flexible and convenient solution for financing everything from a new car to a dream vacation.

1 2 3 4 5